Since the inception of the Master Policy in 1978, the lead insurer has been Royal & Sun Alliance (RSA). There are also a number of other 'co-insurers'. For 2019-20, the Insurers are as follows:

Master Policy guide contents

Go directly to a section, or navigate through using the forward/back buttons

What is the Master Policy?

…the professional indemnity insurance policy for all Scottish law firms.

The Law Society of Scotland Master Policy for Professional Indemnity Insurance ('Master Policy') is the compulsory professional indemnity policy for solicitors in private practice in Scotland..

Unlike the professional indemnity arrangements for Solicitors in England & Wales, where firms can purchase insurance from one of a number of 'Participating Insurers' (insurers that agree to minimum policy terms & conditions determined by the regulator), solicitors in Scotland have the benefit of a Master Policy - a single policy which provides professional indemnity insurance cover for all law firms regulated by the Law Society of Scotland.

Principal Benefits

One benefit of a Master policy is that it enables Lockton, as broker for the Master Policy, to negotiate robustly to obtain the best possible renewal terms for all practices, regardless of size.

Why have a Master Policy?

It provides financial protection for practices, individual solicitors, and the public

It underpins the trust clients have in their solicitor

It provides fair and transparent pricing for all firms

All practices can benefit from the purchasing power a Master Policy brings

It provides cost-effective 'run-off' cover for closed practices in perpetuity (for as long as the Master Policy exists)

Guaranteed service levels provided to all firms by Lockton

Lockton's role as a broker

Strong Negotiator

We negotiate with A-rated insurance markets each year to ensure that the Master Policy is renewed on as competitive, and sustainable, terms as possible.

Efficient Administrator

We administer your Master Policy renewal process to stringent service requirements set down by the Law Society. Our online resources, including our client portal and online renewal process, help make the renewal process faster and simpler.

Trusted Adviser

We act as a trusted adviser to your business, to help you manage your risks most effectively and thereby reduce the costs of doing business.

We identify claims trends and highlight emerging risks - and help the profession develop strategies to mitigate and manage these risks.

As one of the UK's largest specialist brokers for professions, we can also advise you on, and arrange for you, a comprehensive suite of additional insurances, including;

- 'top-up' professional indemnity cover, if the £2m Master Policy is insufficient for your needs

- Cyber & Crime insurances

- Office insurance.

As a Lockton client, it is important that you have a clear understanding of our role, the scope of our services, and how we are paid. Our Terms of Business set this our clearly, and form our service contract with you.

First Point of Contact

We are your direct point of contact for any Master Policy related matters, including claims intimations, changes to your practice, and any general queries.

You can contact the Lockton Master Policy team

For more information about Lockton, read Our Story.

Who are the Master Policy insurers?

How much cover does the Master Policy provide?

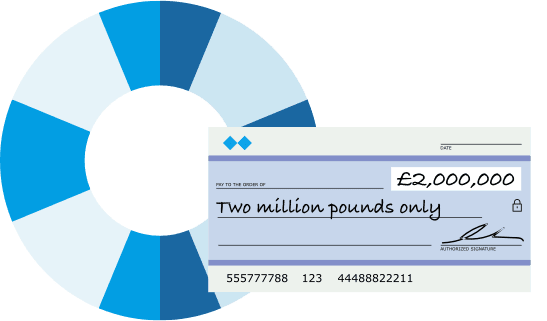

Master Policy provides cover on a 'claims made' basis. That is, the amount of cover which applies is that which is in place at the date a claim or potential claim ('a circumstance') is intimated to Insurers.

Currently the Master Policy limit of indemnity is £2,000,000

(any one claim). This is your 'primary' layer of insurance.

Many firms purchase additional layers of 'top-up' cover to increase their level of cover beyond the £2 million offered by the Master Policy. You should determine what is an appropriate level of cover for your firm, based on the nature of the work you undertake, remembering that claims can arise several years after the work giving rise to the claim was undertaken. Contact the Master Policy team at Lockton for further guidance on your individual requirements.

Top-up cover which dovetails seamlessly with your Master Policy cover can be arranged through Lockton. You can purchase this at the same time as your Master Policy, without the requirement to fill out any other forms. You can also purchase 'Top-up' cover at any time during the year.

Top-up cover can be purchased in £1m increments, and is typically split into 'layers' as follows:

| Professional Indemnity Layer | Total Limit of Indemnity |

|---|---|

| Master policy | £2,000,000 |

| Top-up Layer 1 | Up to £5,000,000 |

| Top-up Layer 2 | Up to £10,000,000 |

| Top-up Layer 3 | Up to £25,000,000 |

| Top-up Layer 4 | Up to £50,000,000 |

| Top-up Layer 5 | Up to £100,000,000 |

| Top-up Layer 6 | Up to £200,000,000 |

Please note: Top-up cover is not available for single transactions

What is covered?

The Master Policy provides cover for any civil liability arising out of 'business… customarily…transacted by solicitors in Scotland'. This is one of the widest basis of cover available to any UK professional firm.

Cover for Activities undertaken by a solicitor

Almost any type of work is covered by the Master Policy, as long as it is customarily undertaken by solicitors in Scotland, and undertaken by the solicitor concerned, in their capacity as a solicitor in the firm in question.

Activities Covered by the Master Policy include:

- Executor

- Trustee

- Judical factor

- Guardian

- Power of Attorney

- Director (legal advice only)

- Company Secretary

- Treasurer

- Auditor

- Liquidator

- Administrator/Receiver

- Mediator or Arbiter

- Locum

- Consultant

Types of Claim covered by the Master Policy

Claims can arise from a variety of causes, the majority of which are covered under the Master Policy, although some claim types have specific cover conditions or sub-limits applied. There are also a small number of exclusions. Lockton can readily clarify any policy cover queries you may have.

| Types of Claim Covered by the Master Policy |

|---|

| Fraud/Dishonesty - loss of clients' money subject to there being an innocent Principal |

| Bank failure - loss of client monies only where the practice has been negligent |

| Loss of Documents to £250,000 subject to conditions re electronic document storage |

| Defamation |

| Court attendance costs in relation to claims against the Practice - see rates in Certificate of Insurance |

| Undertakings different self-insured amounts may be applicable |

| England & Wales work |

| Other Foreign Work (excluding work undertaken in USA or Canada) |

| Major Exclusions |

|---|

| Fraud/Dishonesty - loss of firm's own money |

| Personal financial guarantees |

| Work undertaken in USA/Canada |

| Regulatory fines |

| Liabilities properly insured under other policies |

This summary is for guidance purposes only. Please consult your policy or speak to your Lockton broker for details of full terms and conditions of cover.

Master Policy Renewal Process

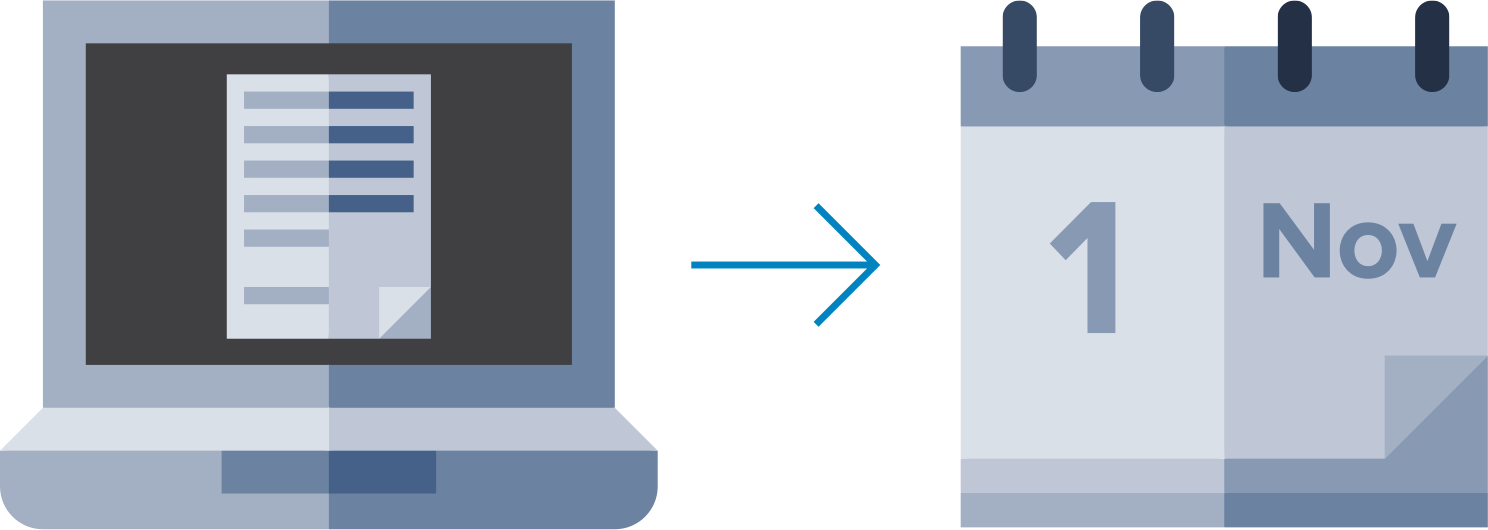

Lockton has introduced a secure client portal which provides any-time access to your insurance documentation, alongside a wealth of practical guidance and CPD learning modules. It also contains your online proposal form, for simpler and quicker renewal of your Master Policy, Top-up Cover, and a wide range of other business insurances.

The Master Policy renews on 1st November annually. We will email the registered Master Policy Contact in each firm in advance of renewal with a link to the proposal form to complete.

Our online renewal process offers the following benefits:

ONLINE PROPOSAL FORM

- You can start the renewal process earlier: our online proposal form allows completion at a time that suits each firm.

- Eliminates errors in submitted forms, meaning fewer 'returned' forms.

SIMPLIFIED RENEWAL

- We've simplified your proposal form to make it easier to complete.

AUTOMATIC ACKNOWLEDGEMENTS

- We will keep you informed of the progress of your Professional Indemnity renewal with email updates.

- Alerts are flagged and correspondence stored on the secure client area of the online client portal.

FAST QUOTATIONS

- Receipt of a correctly completed proposal form in the majority of cases will generate a quote within 2 Business Days.

EASIER PAYMENT PROCESSES

- Payments by credit and debit card will be possible.

- Premium Credit options will be electronically processed with the minimum of additional forms.

QUICK POLICY DOCUMENT GENERATION

- On confirmation of payment policy documents will be generated immediately and stored on your client portal for any-time access.

- You will be able to generate Evidence of Cover documents as required.

How is my premium calculated?

Lockton negotiates a 'global premium' with insurers annually, as part of the Master Policy renewal process. This global premium is then apportioned between participating practices according to a transparent pricing formula, which takes into account several factors including: number of principals, fee income, and claims record. This continues to offer practices a much greater degree of price certainty for Practices than an open-market model.

The formula is based on:

Rates & Rating Factors

- Number of Chargeable Principals (a Principal of a Practice Unit means, in relation to that Practice Unit, a sole practitioner, a partner in a partnership, a member of a limited liability partnership, a director or shareholder of a company. A Principal of a Practice Unit also includes any individual being held out as, designated as or otherwise represented as a partner of a Practice Unit, irrespective of the business structure).

- Gross Fee Income (for the last complete Financial Year)

- Work types different work-types typically produce more/higher value claims. The Master Policy Insurers therefore rate some work types differently. Our work - type risk profiler can provide you with an indication of the risk profile of different work types.

Please note, this is for general risk management guidance only and does not provide information about the ratings applied to work-types under the Master Policy. - Loss Ratio the ratio of premium paid to claims paid and reserved over a 5 year period.

- Self-Insured Amount (often referred to as the 'policy excess'). The Master Policy offers Practices three self-insured-amount (SIA) options, in order that you can select one that best suits your business needs. If you opt for a reduced SIA your premium will be slightly higher. Conversely, if you choose to double your SIA, you will receive a reduction on your Master Policy premium.

For more information about the rates and rating factors, you can view our Rating Infographic on our website.

Notifying Claims to Lockton

What & When to Notify

You should intimate claims (or circumstances which could give rise to a claim) as soon as possible. A 'claim' is most obviously identified by the service of legal proceedings, but can equally be made by a letter of demand, or orally. Similarly, a potential 'circumstance' can be an issue that you, or someone else within the firm, has identified that has not yet been notified as a claim by the client concerned.

"When in doubt, notify"

If you are unsure whether or not to notify something, speak to us. Remember that notification with a nil reserve do not impact on your record for premium purposes, and keeping a comprehensive record of potential issues can help you track patterns of behaviour and identify more systemic problems early. Late notification, in contrast, can give rise to problems for practices regarding the handling or settlement of a claim. Insurers are entitled to apply a number of special conditions, including reducing the amount payable in settlement of a claim, where your delay in notifying has prejudiced the handling or settlement of the claim.

If you have not disclosed material information or have misrepresented facts to insurers you may be required to pay an additional premium, which can be applied retrospectively. It is important to note that 'Circumstances' (i.e. not formal notification of known claims) are not taken into account for premium loading purposes.

How to Notify

Email MasterPolicyClaims@uk.lockton.com or your regular Lockton contact explaining the factual background, and include all relevant correspondence.

What happens once you have notified a claim/circumstance?

As soon as your claim is logged it will be reviewed by an experienced claims handler at the lead insurer, RSA, unless there is a conflict of interest, in which case, a co-insurer claims handler will be appointed.

Insurers will then contact you direct to discuss the investigation and handling of the matter. Insurers have control over conduct of the claim. For high value or complex matters one of the insurers' panel firms may be instructed. Panel Solicitors' fees are paid by the insurers, however, any VAT on these fees (should your practice be VAT registered) will be payable by the practice.

You will be kept regularly advised of progress by the Insurer handling your claim. In case of any dissatisfaction with the handling of your claim, you should speak to that insurer, or to us at Lockton, in the first instance.

Lockton are available to discuss any claims queries you may have, including analysis of claims data and questions on reserving or settlement of claims.

Making a claim or complaint against a Solicitor

If you are a client of a solicitor in Scotland, and wish to make a claim, you should, in the first instance contact the solicitor concerned. Because the solicitor is the insured party under the policy, only they (or their representative) can notify a claim.

For more information, the Law Society of Scotland (which regulates the profession in Scotland) has produced some guidance - and, if required, can help you find a suitable solicitor to assist you in making your claim.

If you have a complaint about the nature of the service you have received from a Scottish solicitor, you can also contact the Scottish Legal Complaints Commission ('SLCC'). The SLCC has produced a short guide to help you decide whether you can make a complaint to them.

Starting a Practice

Please contact us as early as possible when you are considering starting a new practice. You should also contact the Law Society. They have provided guidance on Starting a New Practice which you may find helpful.

Be aware that your Master Policy cover must be in place before you can start practicing, therefore you will need to complete a New Practice Proposal form.

Contact us and we will set you up with a username and log-in to access your proposal form.

We can also assist you by providing free access to a range of useful templates, checklists and guidance which can help you start your practice on the right footing. We also have a 'Starting a Practice - planner' to download in our Resource Centre.

Changes to your Practice

The Insurance Act 2015 requires Practices to disclose all material circumstances (defined as any information that would influence an Insurer's decision regarding the terms of that insurance).

If there are material changes to your Practice during the course of the year, we need to know. Such changes include:

- changes to Partners/Principals;

- conversion to an LLP, Ltd Co, or ABS;

- addition/removal of any JV partnerships, trading styles, etc

- opening of new offices - particularly if overseas

- change of address

- change of key personnel (Master Policy contact; Claims Contact; Risk Management Contact)

- anticipated mergers, break-ups, or dissolution of your practice

- significant change in anticipated fee income or work-types

- withdrawal of criminal court undertaking

Many of these changes can be instructed directly, online, using the Update Details section on the client portal. You should provide us with updated details as early as possible to ensure that you comply with your obligations under the Insurance Act.

Please note - there is no increase in premium due or rebate of premium payable for changes in the number of Principals or changes in anticipated fee income during the policy term.

Mergers, Aquisitions & De-mergers

Mergers, acquisitions and de-mergers can all have significant implications for a practice's cover under the Master Policy. The key question to be addressed is whose Certificate of Insurance will provide indemnity in the event of a future claim arising out of the past activities of a practice.

Practices can opt to take on the liabilities of a past practice. If an acquiring practice does not assume responsibility for insuring the past activities of a merging practice, then the practice will cease and go into "run-off" (this is the ongoing cover provided under the Master Policy for all practices that have ceased trading. Contact us for more information about the terms and conditions applying to run-off cover.) There may be a charge for this run-off cover.

The financial implications of either approach are dependent on the specific circumstances in each case. Practices should therefore contact us at the earliest opportunity to discuss the implications of any potential merger, acquisition or de-merger. Your enquiry will be treated in strictest confidence.

Please note the impact of claims in the event of a de-merger. You will have to decide on the:

- allocation of premium contributions record

- allocation of claims/circumstances record

- allocation of future claims/circumstances

This will have to be agreed as between the Principals of the de-merging practice. Please contact us for more information and guidance.

Closing Down/Retiring

If you are considering retiring/closing-down your practice it is important to start planning early. Please contact us as soon as possible, to allow time to discuss the options and the potential implications for your Master Policy cover and premium.

If you do not anticipate there being a 'successor practice', the cover for your practice will go into 'run-off' on the date of cessation. There may be a charge for this continuing 'run-off cover'. We will require ongoing contact details for any claims or other queries that may arise. We will also continue to provide a certificate of cover annually.

We can also provide you with guidance on Succession Planning and Practice issues arising from retirement.

Go directly to a section, or navigate through using the forward/back buttons